The Islamic financial system comprises four main components namely Islamic banking takaful and retakaful Islamic Insurance and re-insurance. Bank Negara Malaysia the Central Bank of Malaysia is empowered to act as the regulator for all banking institutions including investment banks in Malaysia.

Difference Between Banks And Nbfcs In India Enterslice

For Financial Market it comprise with four major markets that is Money Foreign Exchange Market Capital Market Derivatives Market.

. The Malaysian banking sector consist of 27 commercial banks including 19 licensed foreign banks 11 investment banks 18 Islamic banks as well as non-bank financial institutions. Led by Ivy Yee and Johan Adam Jurohni and founded in 2009 I-Max Financial Sdn Bhd is a financial planning firm licensed by Bank Negara Malaysia and Securities Commission of Malaysia. Financial system in Malaysia is structure in to two categories that is Financial Institutions and Financial Market.

These strategic sectors include agriculture small and medium enterprises SMEs. Of the people in peninsular Malaysia 539 per cent are Malay 349 per cent Chinese and 105 per cent Indian. The population of Malaysia based on 1980 estimates is 14261200 with the major part some 11849000 living in West Malaysia.

It supervises and controls all banking institutions incorporated under the Financial Services Act 2013 Islamic Financial Services Act 2013 and the Central Bank of Malaysia Act 2009. Islamic banks accounted for 242 or RM695bil of the countrys total banking assets as of end-July up from 237 last year. F Bank Pembangunan Malaysia Berhad Bank Perusahaan Kecil Sederhana Malaysia Berhad SME Bank Export-Import Bank of Malaysia Berhad EXIM Bank Bank Kerjasama Rakyat Malaysia Berhad Bank SimpananNasional Bank Pertanian Malaysia Berhad Agrobank OTHER DFIs not prescribed under the Development Financial Institutions Act 2002 NO.

The development financial institutions DFIs in Malaysia are specialised financial institutions established by the Government with a specific mandate to develop and promote key sectors that are considered to be of strategic importance to the overall socio-economic development objectives of the country. Its purchases of loans and debts through the issuance of Cagamas bonds. EXPORT CREDIT REFINANCING 21 Method of Financing 22 Period and Margin of Financing 23 Repayment 3.

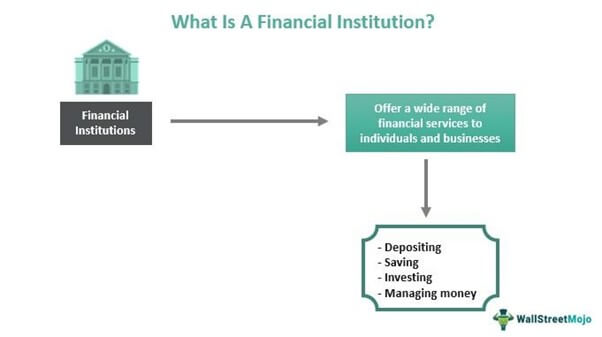

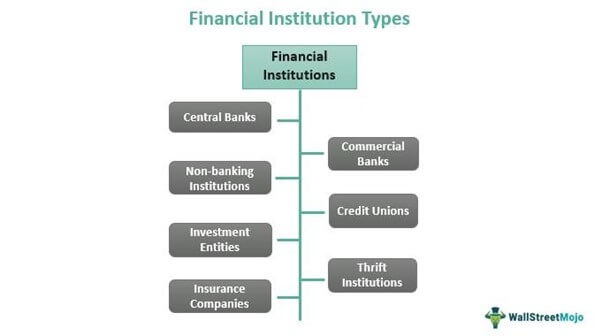

The Islamic financial system comprises four main components namely Islamic banking takaful and retakaful Islamic Insurance and re-insurance. Islamic banks accounted for 242 or RM695bil of the countrys total banking assets as of end-July up from 237 last year. Financial Institutions FIs conducts financial transactions such as investments loans and deposits taking deposits providing advice to corporate and government clients or offering financial contracts such as insurance permit the flow of funds between borrowers and lenders by facilitating financial transactions.

It issues corporate bonds. THE CAPITAL MARKET IN MALAYSIA 31 Securities Commission Malaysia 32 Bursa Malaysia 4. As at end-June 1999 the combined Islamic financing extended by the three institutions amounted to RM164 million US432 million.

The Islamic financial markets in Malaysia comprise the Islamic Money Market and the Islamic Capital Market. Sabah and Sarawaks populations are respectively 1097800 and 1314400. Zakah Administrati on in Malaysia Zakat institution is an integral.

The company consists of a team of financial advisers that assists its clients to meet their financial needs and goals by equipping them with the right type of. Institutions carrying on banking finance company merchant banking discount house and money-broking businesses for the regulation of institutions carrying on certain other financial businesses and for matters incidental thereto or connected therewith. Islamic interbank money market and Islamic capital market.

Islamic bank loan growth in the country expanded by 89 percent in 2018 compared to 25 percent for conventional banks. THE FINANCIAL SYSTEM IN MALAYSIA 11 The Central Bank 12 Financial Institutions 121 Islamic Financial Industry 122 Development Financial Institutions 2. National Mortgage Corporation of Malaysia was established in 1986.

The Financial Industry Collective Outreach FINCO is a collaborative initiative pioneered by all financial institutions in Malaysia with the support of Bank Negara Malaysia. Under financial institution there are Banking system and Non-Bank Financial Intermediaries. An organization that purchases financial institutions loans at a discount.

To promote the broader spread of house ownership and growth of the secondary mortgage market in Malaysia. Islamic financial institutions can benefit from fintech in many of the same ways that conventional finance does. While Islamic fintech is still in its infancy in Malaysia the central bank supports efforts to promote the sector.

In respect of scheduled institutions1 January 1990 PU. The Islamic Money Market introduced in 1994 may be regarded among the most. The introduction of the Banking and Financial Institutions Act 1989 BAFIA on 1 October 1989 extended BNMs powers for the supervision and regulation of financial institutions and deposit-taking institutions who are also engaged in the provision of finance and credit.

33 rows Banks in Malaysia. Made up of Depository. The DFIs in Malaysia are specialised financial institutions established by the Government with specific mandate to develop and promote key sectors that are considered of strategic importance to the overall socio-economic development objectives of the country.

Our big goal is to provide underprivileged children and youth with the guidance and educational tools they need to achieve their life goals. Islamic interbank money market and Islamic capital market.

Hong Leong Bank Berhad Swift Codes In Malaysia

World Bank Malaysia Home Facebook

Overview Of Financial Inclusion In Malaysia Bank Negara Malaysia

Financial Institutions Meaning Types Functions Example

Types Of Payment Systems Bank Negara Malaysia

Climate Change Bank Negara Malaysia

Sustainable Banking And Finance Network Sbfn Linkedin

Network For Greening The Financial System Ngfs Twitter

Climate Change Bank Negara Malaysia

Cash Transaction Limit Ctl What You Need To Know Bank Negara Malaysia

Nbc Cambodia Nbccambodia Twitter

Covid 19 Impact On The Banking Sector Kpmg Global

What Bankers Need To Know About The Mobile Generation Need To Know Generation Retail Banking

Financial Institutions Meaning Types Functions Example

Logo Bank Malaysia Clerk Jobs Professional Resume Samples Manager Resume

Overview Of Financial Inclusion In Malaysia Bank Negara Malaysia

Malaysia Resources And Power Britannica

Banks In Malaysia Overview Guide To Top Banks In Malaysia